My friends ask me, what do you invest in? I tell them mostly REITs and banks. If you don’t how to choose which REIT to invest in, maybe go with REIT ETF. Then they ask, which one? Lion-Philip S-REIT ETF or Nikki AM REIT ETF?

In this post, I will do a comparison between these 2 REIT ETFs. I did not include Philip REIT ETF because the expense ratio is much higher and also, of the geographical difference. Refer to my previous post.

Basics

Lion Philips S-REIT ETF

- Tracks Morningstar Singapore REIT Yield Focus Index

- Expense ratio of 0.60%

- Semi-Annual Dividend payout

- Current Yield (as of 10/06/2020) – 5.19%

- (I couldn’t find any info on tracking error)

Nikko AM REIT ETF

- Tracks FTSE EPRA Nareit Asia ex Japan Net Total Return REIT Index

- Expense ratio of 0.60%

- Quarterly Dividend payout

- Current Yield (as of 10/06/2020) – 4.52%

- Tracking error of 0.25%

Country allocation

From my previous post, Nikko Am REIT ETF has REITs majority listed from Singapore and Hong Kong. Lion Philip S-REIT has REITs listed from Singapore only.

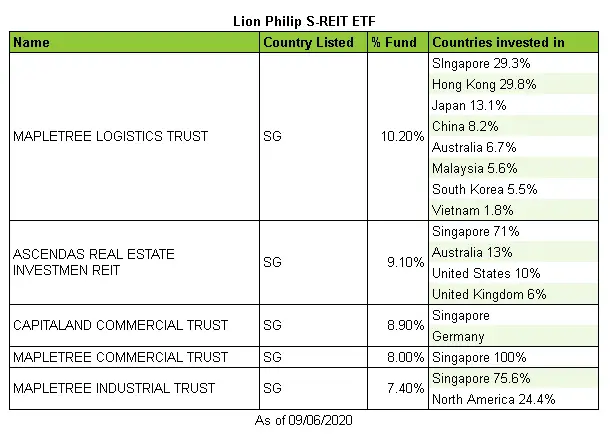

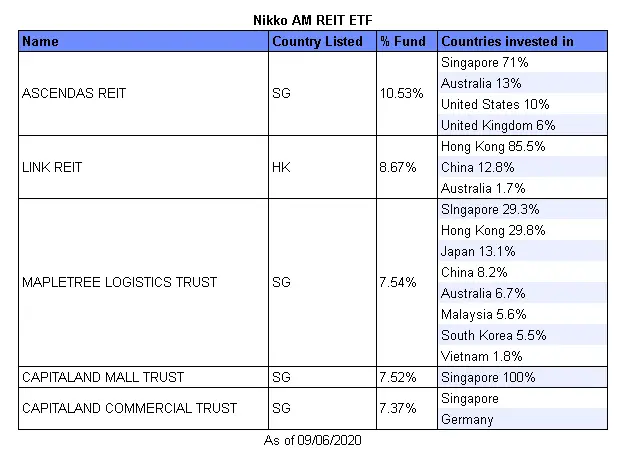

Just because a REIT is listed in a certain country doesn’t mean that the REIT is invested in that country only. Let’s take a look at the top 5 REITs from each ETF

From the above tables, the top 5 holdings from Lion-Philip S-REIT ETF and Nikko AM REIT ETF consists of REITs listed in SG and HK. However, if we look at the countries in which the REITs are invested in, most of the REITs consists of properties from other countries as well.

Investment Mode

Nikko AM REIT ETF

- Regular Savings Plan via DBS/POSB Invest Saver or FSMOne

- Lump Sum via any of the local brokerage houses

Lion-Philip S-REIT ETF

- RSP via OCBC Blue Chip Investment Plan

- Lump Sum via any of the local brokerage houses

Summary

Both these ETF yields between 4 to 5-ish%, which to be honest, isn’t that great from REITs. ETFs tend to include larger cap REITs which usually has a lower yield. Smaller caps REITs with higher yields are usually excluded from it.

If you are looking for a passive way of investing, and you don’t mind paying the 0.6% expense, I would say both of these REIT ETFs are the way to go. Cause with a small amount of money, you get diversification across countries and sectors. You also do not have to worry about a particular REIT going bust (e.g. EHT).

Which REIT ETF should you choose?

Honestly, I felt like this was where I had to choose between a white or a brown egg.

If it was up to me, I would go with the Lion-Philip S-REIT ETF as I am more familiar with the SGX listed REITs. And also it has a slightly higher yield than the Nikko AM one.

But if you want one which has a higher frequency of dividend payout, or if you want to do RSP with DBS invest saver, then go with Nikko AM REIT ETF.

At the end of the day, they are all eggs. Highly nutritious and yummy. ?