Whenever I received my bonus for the year, I would usually spend 10% of it, save 20%, and do a lump sum investment with the rest of the money. Lately, I have been wondering if doing a lump sum investing is a better strategy compared to dollar cost averaging.

What is Dollar Cost Averaging Strategy?

Dollar cost averaging is a strategy, where you invest a fixed amount of money at regular intervals e.g. every month, regardless of the market condition, over an extended period of time.

This means that you invest when market is high, you invest when market is low. With this, you get an average cost of the market over time.

What is Lump Sum Investing?

As the name suggests, it simply means investing a significant amount of money all at once into the market. You could time the market, or you could just invest right away to gain exposure to the market sooner rather than later.

Dollar Cost Averaging vs Lump Sum Investing returns

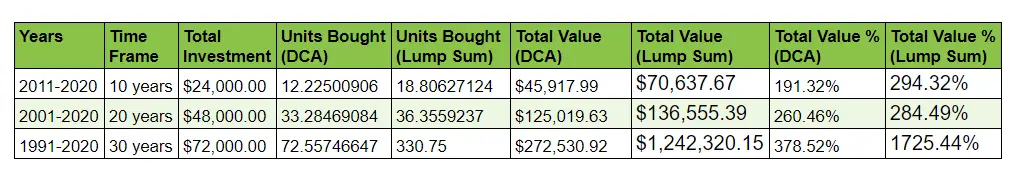

Back testing with historical data from Yahoo Finance on S&P 500

Based on these assumptions:

- DCA: Invested $200 every month on the high of the day on the 1st or next working day

- Lump sum investment (LSI): Invested on the 02 Jan of the beginning of the years.

E.g. for 30 years, lump sum investment was done on the 02/01/1991

From the table above, we can see that lump sum investing (LSI) wins in all cases.

10 Years: We see an approx. 100% more gain from lump sum investing compared to DCA. When we look at the chart below, it’s easy to see why. 2011 is where the S&P 500 is just starting to recover from the 2009 crash. And it is in this decade where we see the most explosive uptrend happening.

20 Years: Now with this period, the returns between DCA and LSI are rather similar, with the LSI narrowly wining. Again if we look at the chart, 2001-2011, the market was range bound. But after that, it’s uptrend all the way.

30 Years: This time frame sees the biggest gains for both DCA and Lump Sum Investment (LSI). But if you compare the returns for this period between DCA and LSI, that is a 378.52% vs 1725.44% in returns!

Looking at this chart, it’s easy to see why lump sum investing triumphed dollar cost investing in each scenario. The S&P 500 is one index that has been consistently been on an uptrend.

And also, the lump sum investment happened at beginning of these years 1991, 2001, 2011, which weren’t the peak for the time frame.

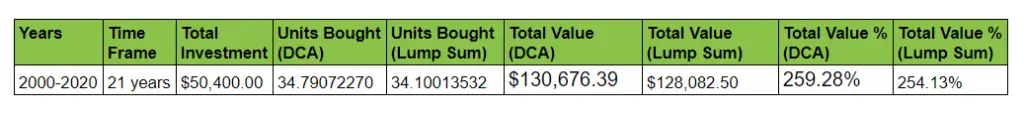

So I thought, what about if I started on 2000, where market was at high during that time.

The dollar cost averaging returns edges out in this scenario. I would think if the market continues to trend up in the future, then Lump Sum Investment would also win here.

Next, I wanted to test this out with a market that hasn’t seen the same uptrend success as S&P 500.

I thought our very own Straits Times Index (STI) would make a good candidate here. After all it was the worst performing Asian market in 2020.

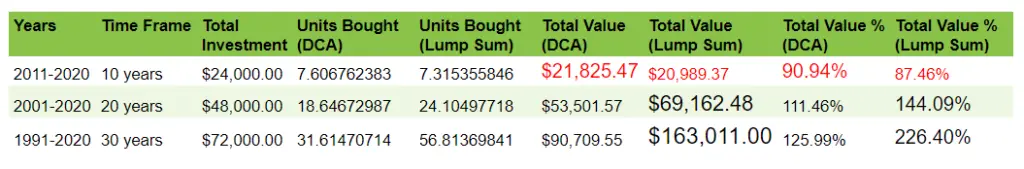

Back testing with historical data from Yahoo Finance on STI (Straits Times Index)

Based on these assumptions:

- DCA: Invested $200 every month on the high of the month (couldn’t download daily data for STI)

- Lump sum investment: Invested on the 02 Jan of the beginning of the years.

E.g. for 30 years, lump sum investment was done on the 02/01/1991

10 Years: Both strategy delivers negative returns! Although dollar cost averaging (DCA) strategy did slightly better. Looking at the chart, 2011-2020 was a range bound market for STI. No uptrend seen in this.

20 Years: Lump Sum Investing (LSI) wins in this case. Again, we can see a very slight uptrend between these 20 years.

30 Years: And again, this time frame sees the biggest gains for both DCA and LSI strategies.

The chart for STI is rather range bound with a slight up trend.

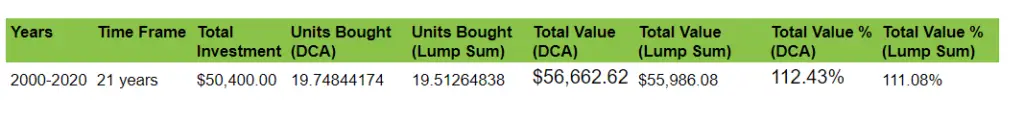

So again, I wonder, what happens if I started at market peak at 2000.

Not much of a difference here in returns. Even when we look at the gains, it’s only a 11-12% gain. For a 21 year period, that is low.

Dollar Cost Averaging vs Lump Sum Investing: Which one delivers better returns?

In short, Lump Sum Investing delivers a better return when you are investing in a longer time frame such as 30 years period. This is on the assumption that the market always goes up.

However in a range bound market, dollar cost averaging strategy will deliver slightly better than Lump Sum Investing (unless you are able to time the market and buy at the bottom with LSI).

The long story. This is my personal view based off these 2 tests

- The longer your time frame, the better your returns, for both dollar cost averaging strategy and lump sum investing

- Lump Sum Investing works extremely well in an uptrend market in a longer period of time.

- Dollar Cost Averaging works better than Lump Sum Investing (LSI) in a range bound market. Although that doesn’t mean it will deliver a positive return. It just means it is a better strategy than LSI.

- The market you choose will greatly impact your returns. Up trend market is always better. Even in dollar cost averaging strategy.

- No amount of dollar cost averaging can save you from a down trending market. This is based on the negative returns that we see on the 10 years of range bound market on STI. The returns is going to be worse for a downtrend market.

What to do if I don’t have a lump sum to invest?

You could ether save until you have a significant amount of money to invest, or just go with the dollar cost averaging strategy.

Personally, I use a combination of both. I continue to stay invested every month using the DCA strategy, but I also build a war chest on the side, to take advantage of any major dips in the market (like the one we saw in Mar 2020).

As always Past Performance is No Guarantee of Future Results.

I would love to hear what you think about this.