Before deciding which index ETF to invest in, you can find out more on what an ETF is, or what an Index is, and why invest in ETFs here.

An Overview: RSP vs SPY

| Invesco S&P 500®Equal Weight ETF (RSP) | SPDR® S&P 500® ETF (SPY) | |

|---|---|---|

| Benchmark Index | S&P 500® Equal Weight Index | S&P 500® Index |

| Expense Ratio | 0.20% | 0.0945% |

| % of 10 Largest Holdings | 2.49% | 29.3% |

| Dividend Yield | 1.66% | 1.44% |

RSP vs SPY – Main Difference

RSP tracks the S&P 500® Equal Weight Index. An equal weight index ETF invests an approx. equal amount of money in each stock that makes up the index. SPY tracks the S&P 500®Index, which invest based on the market cap of the stocks. This means companies with largest market cap will have the highest weight.

Because of this, we can see a distinct difference in the % of the top 10 holding. Top 10 in SPY makes up almost 30% of the total fund. Whereas in RSP, there is no top 10, because all the companies in the fund has equal weightage.

Other Differences

RSP has a higher expense ratio at 0.20% compared to SPY’s 0.0945%. This means for every $10,000 invested, you pay $20 in fee for RSP vs $9.45 for SPY.

Dividend Yield is at 1.66% for RSP and 1.44% for SPY.

Sector Allocation

| Sector | Invesco S&P 500®Equal Weight ETF (RSP) | SPDR® S&P 500® ETF (SPY) |

|---|---|---|

| Information Technology | 13.01% | 28.00% |

| Industrials | 15.35% | 8.50% |

| Financials | 14.45% | 12.68% |

| Health Care | 12.86% | 13.33% |

| Consumer Discretionary | 10.83% | 10.44% |

| Consumer Staples | 7.18% | 6.63% |

| Real Estate | 6.00% | 2.49% |

| Utilities | 5.77% | 2.59% |

| Materials | 5.91% | 2.50% |

| Energy | 4.78% | 4.24% |

| Communication Services | 3.87% | 8.59% |

Because RSP allocates equal weightage for each stock, Information Technology stocks only takes up 13.01%. SPY on the other hand is dominated by Information Technology stocks with 28%.

This could be a consideration point if you want an ETF that is not heavily tilted towards Technology stocks.

Top 10 Holdings

| Invesco S&P 500®Equal Weight ETF (RSP) | SPDR® S&P 500® ETF (SPY) |

|---|---|

| ZIONS BANCORP NA 0.24% | APPLE INC 7.53% |

| OLD DOMINION FREIGHT LINE INC 0.26% | MICROSOFT CORP 6.48% |

| NORWEGIAN CRUISE LINE HOLDINGS LTD 0.24% | AMAZON.COM INC 3.02% |

| NEWELL BRANDS INC 0.24% | NVIDIA CORP 2.99% |

| GENERAC HOLDINGS INC 0.24% | ALPHABET INC CL A 2.03% |

| DOMINO’S PIZZA INC 0.25% | META PLATFORMS INC CLASS A 1.82% |

| COMERICA INC 0.24% | TESLA INC 1.82% |

| CARRIER GLOBAL CORP 0.24% | ALPHABET INC CL C 1.75% |

| CARNIVAL CORP 0.26% | BERKSHIRE HATHAWAY INC CL B 1.64% |

| ALIGN TECHNOLOGY INC 0.24% | UNITEDHEALTH GROUP INC 1.24% |

| Top 10 Total – 2.49% | Top 10 Total – 29.3% |

Because RSP is a equal weighted index ETF, the top 10 only makes up 2.49%, compared to SPY’s 29.3%. So again, if you want the ETF where top 10 holdings does not dominate, then RSP is the choice.

RSP vs SPY Performance

Now that we know the main differences between these ETFs, let’s see if these leads to performance difference.

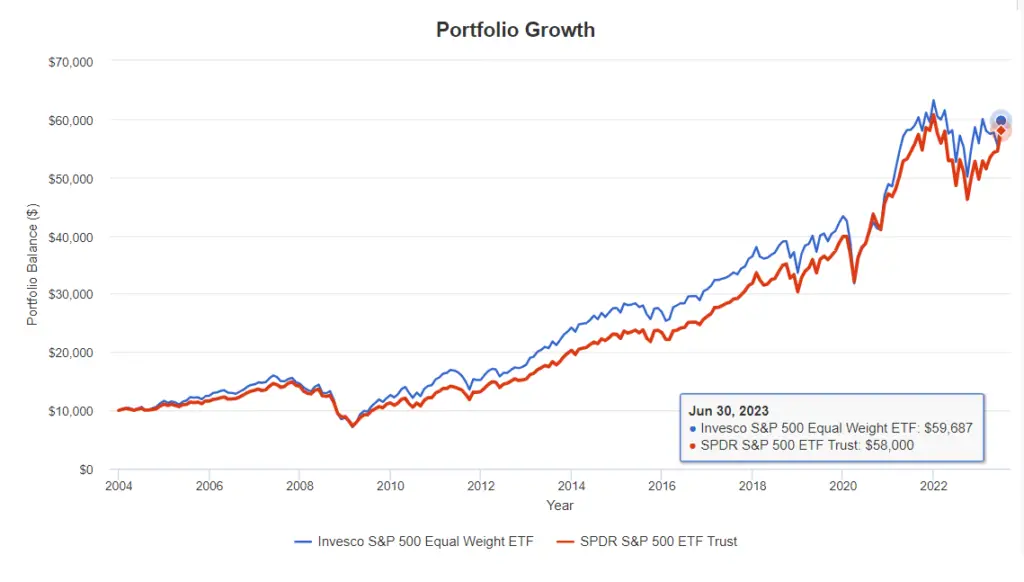

I ran a back test using the Portfolio Visualizer on this 2 ETFs.

This is what you will end up with at the end of Dec 2020 if you have invest $10,000 in 2004.

RSP (Invesco S&P 500®Equal Weight ETF): $59,687

SPY (SPDR® S&P 500® ETF): $58,000

Looking at the graph above, we can see that RSP portfolio was outperforming SPY for most periods, until in 2020.

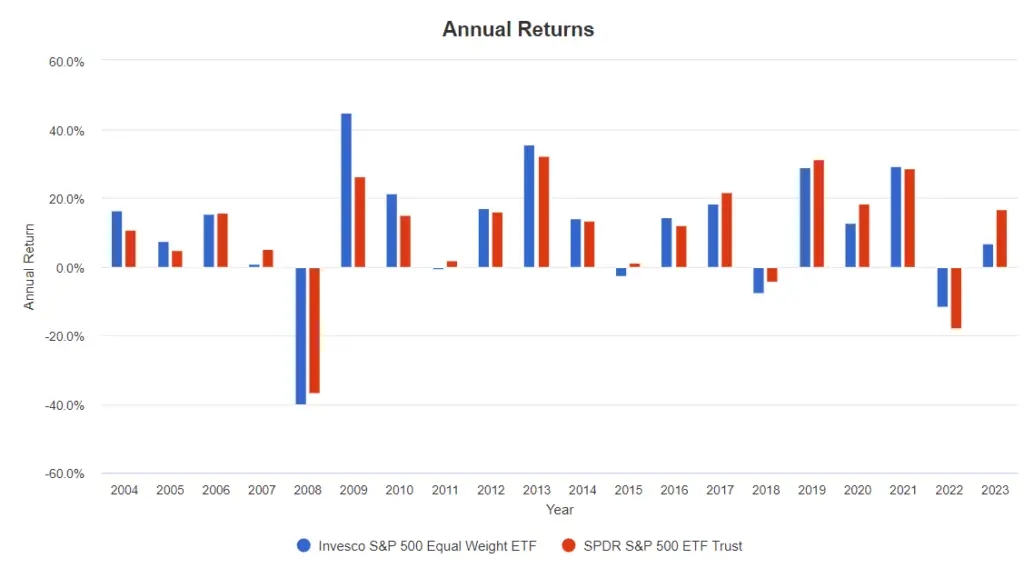

In terms of Annual Returns, RSP returned negative returns on 2008, 2011, 2015, 2018 and 2022. Whereas SPY only had 3 years of negative returns. And on all occasions, RSP performed worse during a down market. This suggest that RSP might be more volatile than SPY.

Now if we look at the Annualized Returns:

| ETF | 1 Year | 5 Year | 10 Year | Since Inception in 1993 |

|---|---|---|---|---|

| RSP | 13.36% | 10% | 11.19% | 10.90% |

| SPY | 19.38% | 12.15% | 12.73% | 9.93% |

We see RSP edging out since inception. But SPY fares much better in the last 10, 5 and 1 year period.

RSP vs SPY: Which Should You Invest In?

If we based on the past performance, it’s a close call. If you invested in 2004, RSP wins by a tiny margin. However, SPY has dominated the returns in the last 10 years. Will it continue to?

With SPY, there is a lot of weightage towards larger companies. And there is only so much a large company can grow. Once a company becomes mature, there would be less growth that comes with it. And we know most of the gains in 2023 came from these large technology companies.

With an equal weighted index ETF like RSP, you will be able to gain more exposure to the smaller companies. And smaller companies tend to have more growth opportunities compared to a large one. In other words, RSP might be more suitable if you are looking for more growth.

The main consideration with investing RSP is it would be more volatile during the down market. This is expected as smaller cap companies tend to be less stable.

So depending on your strategy, if you are looking for more growth, then RSP might be the one to go with. Otherwise, stick to SPY.

As always Past Performance is No Guarantee of Future Results.