Never a dull moment in crypto world. We had the LUNA/UST collapsed just 3 weeks ago, and now we have Celsius on a bank run situation. Even earning yields with stablecoins seems risky now.

Disclosure: I have withdrawn all my coins from CEFI platforms since the whole LUNA/UST depeg fiasco. If you have any holdings, I suggest doing the same. Not your keys, not your coins.

Now, it is back to basics. Earning yields with REITs. I have started allocating funds back to REITs. This time round, instead of using picking my own REITs to invest in, I have decided to go with SYFE REIT+.

What is SYFE REIT+?

Syfe REIT+ is a portfolio that invests 100% into REITs. It aims to track the performance of the iEdge S-REIT Leaders index.

The iEdge S-REIT Leaders Index is the most liquid representation of the SREIT Market in Singapore. It is an adjusted free-float market capitalization weighted index that measures the performance of the largest and most tradable REITS in Singapore

iEdge S-REIT Indices Factsheet

However, it does not replicate the index. The iEdge S-REIT Leaders Index has 28 REITs in it. SYFE REIT+ has an optimized allocation of 20 REITs to try and achieve the same with a tracking error of less than 0.5% p.a.

| Top 10 Holdings |

|---|

| CapitaLand Integrated Commercial Trust (10.4%) |

| Ascendas Real Estate Investment Trust (9.8%) |

| Mapletree Logistics Trust (9.4%) |

| Mapletree Industrial Trust (9.2%) |

| Mapletree Commercial Trust (9.1%) |

| Keppel DC REIT (8.4%) |

| Suntec Real Estate Investment Trust (7.1%) |

| Frasers Logistics & Industrial Trust (6.6%) |

| Mapletree North Asia Commmercial Trust (6.4%) |

| Keppel REIT (5.7%) |

| Total: 82.1% |

| as of 30 Apr 2022 |

These are the top 10 holdings in SYFE REIT+. They account for 82.1% of the entire portfolio. Most of them are quality blue chip REITs.

Why invest in Syfe REIT+ instead of picking your own REITs?

Back in 2020, where I previously wrote an article about this, I mentioned that I prefer to DIY my own REITs portfolio. However, my stance on this has since changed.

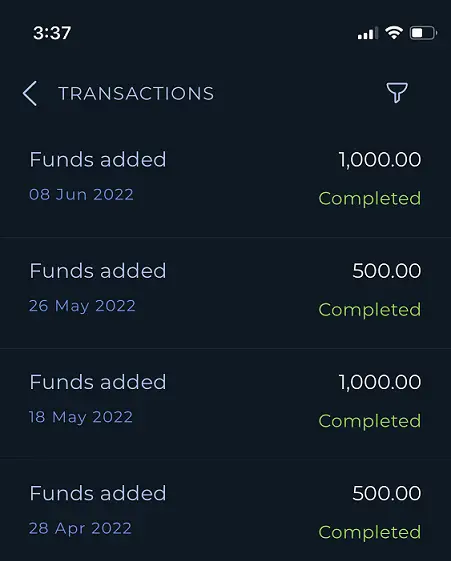

I wanted to automate and DCA every month, and also ah hoc invest some of my crypto earnings into this. And at the same time, I don’t want to spend time managing this portfolio.

Just looking at the top 10 holdings, I know I get quality and diversification. I don’t have to worry about a single REIT going under water and dragging my entire portfolio with it.

So Syfe REIT+ suits what I wanted.

Fees

There is a 0.65% management fee that I will have to pay every year. The fee will be reduced as your portfolio grows bigger.

- 0.65% (below SGD $20,000)

- 0.50% (between SGD $20,000 – $99,999)

- 0.40% (between SGD $100,000 – $499,999)

- 0.35% (above SGD $500,000)

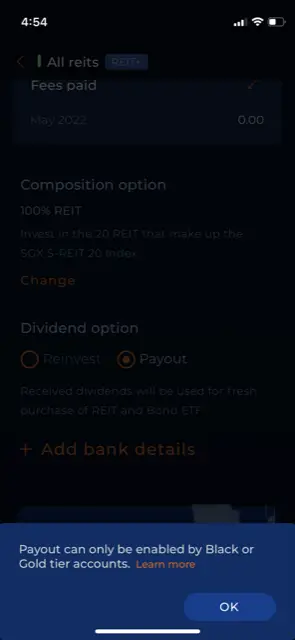

Dividend Payout

There is a slight con with SYFE REIT+. You can’t receive dividend payout if your portfolio is less than $20,000. You will only be able to reinvest your dividend. This is something to note, if you need the dividend to be pay out.

Summary

Syfe REIT+ is perfect for starting and automating your investments.

There is no min. investment amount and you get instant diversification into quality blue chip REITs. Less time managing your portfolio, more time for others.

Lastly, if you are interested in opening an account with Syfe, you can use my referralcode: SRPSWNAD3 at no extra cost.

Disclaimer: As always, none of this content should be taken as financial advice.