The expense ratio tells you the fee that an investment company charges you for managing the fund. This fee is deducted from the fund regardless of whether the fund delivers a positive or negative returns. In short, expense ratio will decrease an investment returns in the long run.

What is an Expense Ratio?

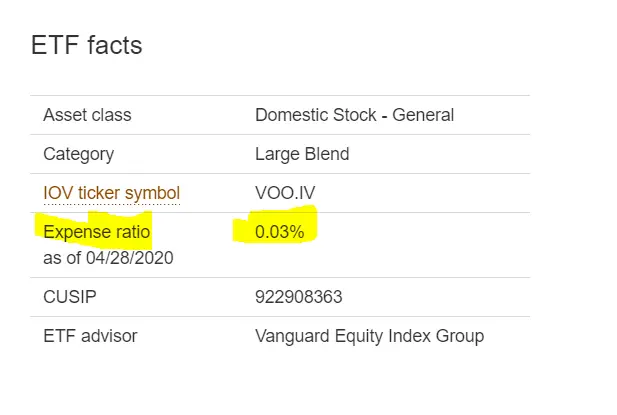

When you buy an ETF or a Mutual fund, you can always find this information on the website or the factsheet.

It is calculated by dividing the various operational cost by the funds average net assets.

How does this affects my Returns?

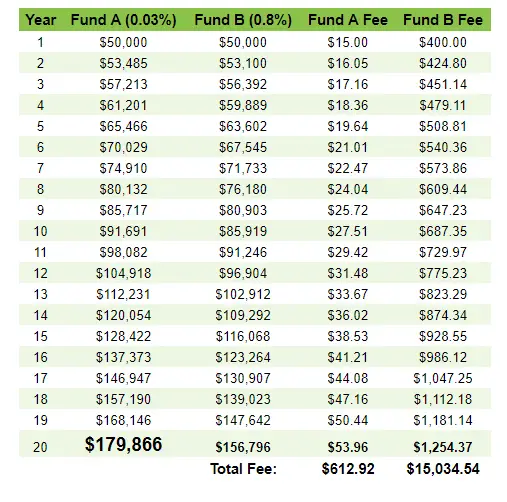

Let’s look at these example:

Fund A has an expense ratio of 0.03%, whereas Fund B has an expense ratio of 0.8%.

Assuming a 7% return every year for the next 20 years, this is how much you will end up with if you invested $50,000.

Fund A (expense ratio of 0.03%): $179,866

Fund B (expense ratio of 0.80%): $156,796

Fund A delivers $23,070 more in returns compared to Fund B. This works out to be 14% more.

When we look at the fees paid, Fund B incurred a total of $15,034.54 compared to $612.92 for Fund A.

From this simple example, we can see how great of an impact the expense ratio has on the performance of fund over time.

What is a good expense ratio for ETFs?

For passive index funds, anything less than 0.2% is typically good.

Personally, I like to look at Vanguard index ETFs’ expense ratio as a gauge when doing comparison. Vanguard are known for their low cost ETFs.

Actively managed funds usually has higher expense ratio. We see ratio ranging from 0.5% to 1%.

Conclusion

The higher the expense ratio, the lower your returns in the long run, assuming that the rate of return is the same.

When is high expense ratio worth it then? I like to use ARK ETFs as a example. They charge 0.75% – 0.76% fee for their active ETFs. And with the high fee, so far they have managed to outperform most of the index ETFs in the last 5 years. So in this case, the high expense ratio is worth it.

But remember, historically, passive index fund usually outperform active funds in the long run. So it is best to stick with low cost ETFs if you are planning to invest for a long term.