In my previous post, I showed you how you can invest in the STI ETF in Singapore using the DBS invest saver.

So what are ETFs?

You know what they always say, don’t put all your eggs in on basket. I like to think of ETF (Exchange Traded Funds) as a basket of securities or stocks. This basket usually tracks an under lying index.

What is an index? In Singapore, we have the Straits Times Index (STI). This index consist 30 of the biggest companies in Singapore. This portfolio of companies represents the Singapore stock market. The US stock market is represented by the Dow Jones Industrial Average(DJIA) index. This index also consist of 30 companies. There is also the popular S&P 500 index which consist of the 500 largest companies in US.

What do I mean by ETF tracks an index? When you buy into e.g. a ETF that tracks STI, it just means that you are buying a fund that buys into the 30 companies in the STI. S&P 500 ETF just means this fund buys into the companies that are in S&P 500.

Why ETFs?

You get diversification with a small amount of money. When you buy into an STI ETF, you are essentially buying into 30 different stocks.

If you were to buy these 30 stocks individually, you will need a lot more money. On top of that, you need to buy according to the weightage of the companies in the index. E.g. DBS makes up 15% of the index. If you have $10,000 to invest, it means you need to buy $1,500 worth of DBS shares.

It is too much hassle to do replicate the index by buying indvidual stocks. You’ll be best to buy an index ETF instead.

How to choose which ETF to invest in Singapore?

When it comes to choosing which ETF to invest in Singapore, other than knowing what index the ETF tracks, these are the 4 other commonly used criteria.

Expense Ratio

One of the main thing to look out for when investing in a ETF is the expense ratio. In simple terms, it means the fee you pay for this ETF. The lower the better.

Tracking error

This just means how close the Fund can track the index it is benchmarking against. The high tracking error usually signals a red flag.

Fund Size (AUM – Asset Under Management)

A bigger fund size doesn’t necessarily means it is better, or vice versa. Fund size matters up until a point. A bigger fund size might indicate liquidity. A bigger fund size might also mean it may have a higher tracking error than a smaller one. Simply because if there is any changes in the component of an index, it would be more difficult for the fund to fill its buy and sell orders. But having a bigger fund size may be help reduce expense ratio.

Dividend Payout

Put simply, does this ETF pays out dividend? Does it matter? It depends on your needs. Do you need constant income from the ETF, if not, it doesn’t matter at all.

What ETFs are available in Singapore?

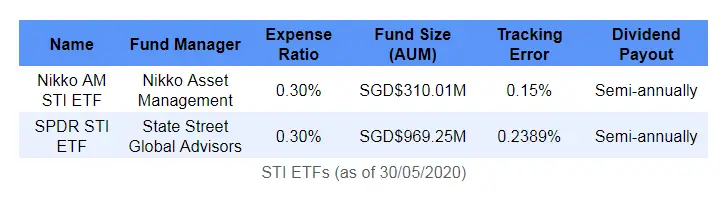

If you are looking into investing STI ETF in Singapore market, there are only 2 ETFs to choose from:

- NIKKO AM STI ETF (SGX: G3B)

- SPDR STI ETF (SGX: ES3)

Both of these ETFs tracks the STI index in Singapore.

ETFs on other exchanges

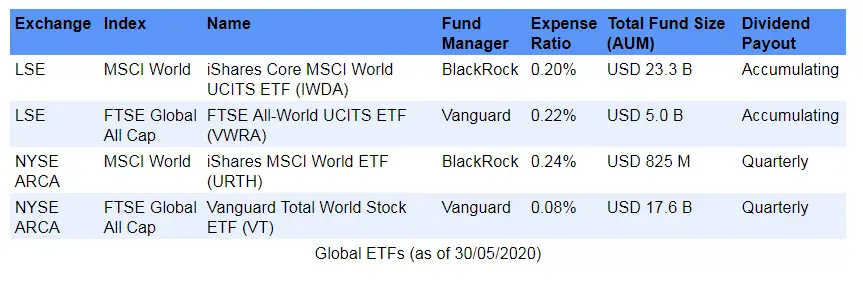

For investing in Global or US market, you can consider the following from either the LSE (London Stock Exchange) or NYSE (New York Stock Exchange). I chose to show only these because BlackRock and Vanguard are 2 of the world’s largest issuer in the ETF industry.

For Global market, these are the 4 ETFs to consider:

- iShares Core MSCI World UCITS ETF (IWDA)

- FTSE All-World UCITS ETF (VWRA)

- iShares MSCI World ETF (URTH)

- Vanguard Total World Stock ETF (VT)

The main difference between the BlackRock ETF and Vanguard ETF is that they track a different index. Let’s look at the difference between these 2 ETFs.

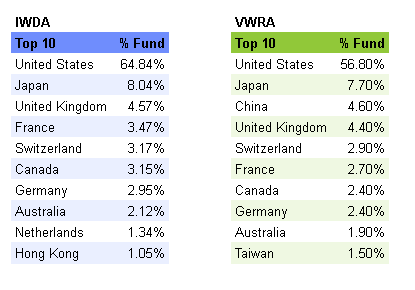

Country Allocation

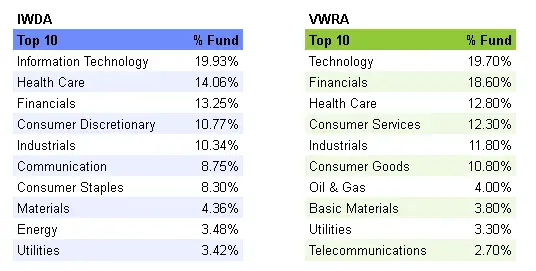

Sector Allocation

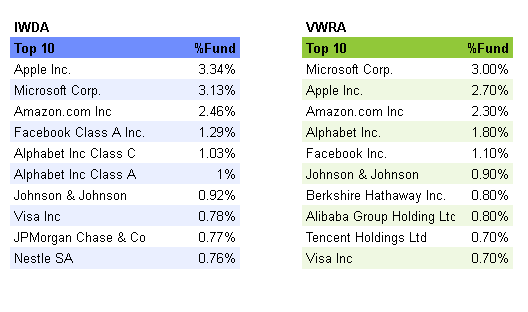

Top 10 Holdings

From the above chart, we can see that main difference is China stocks are included in VWRA but not in IWDA. So if you want exposure to China, maybe VWRA is the way to go.

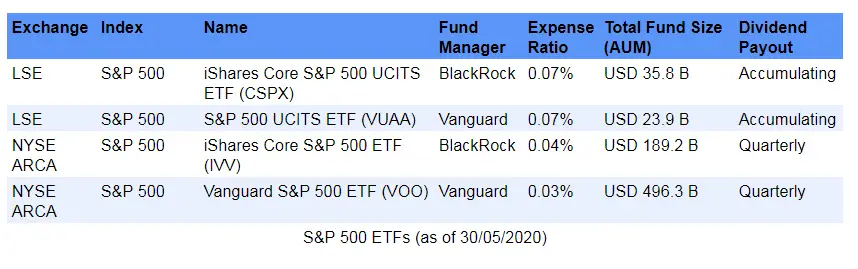

For US market, these are the 4 ETFs to consider:

- iShares Core S&P 500 UCITS ETF (CSPX)

- S&P 500 UCITS ETF (VUAA)

- iShares Core S&P 500 ETF (IVV)

- Vanguard S&P 500 ETF (VOO)

As I am living in Singapore, I prefer to buy from LSE. Simply because you can choose Accumulation Fund type. This means the fund will accumulate all the dividend and reinvest back into the funds.

I prefer not to have Distributing dividend because there is a 15% withholding tax on Ireland domiciled ETFs. For US domiciled ETFs, it is even worse. There is a 30% withholding tax.

For example, if your dividend is $100, on Ireland domiciled ETFs, you will receive $85. For US domiciled ETFs, you will receive $70. The same applies for stocks as well.

How to buy ETFs in singapore

Buying ETFs in Singapore is similar to buying stocks. You will need to open a brokerage account and a CDP account for Singapore listed ETFs.

You can invest via lump sum or as a monthly investment.

I am an advocate of keeping things simple by automation. This is where monthly investment comes into play.

Monthly Investment

For investing in a STI ETF in Singapore, you can simply start a Regular Savings Plan using DBS/POSB invest saver or OCBC’s Blue Chip Investment Plan. If you have brokerage accounts with FSMOne or PhilipsCapital, then you can start a monthly investment with them.

For monthly investment on overseas ETFs, only VT, IVV and VOO are available via FSMOne RSP. There is no easy way for the rest of the ETFs.

You can buy into managed portolio instead. SAXO has just launched their Regular Savings Plan where you can buy into portfolios managed by BlackRock. These portfolio buys into iShares ETFs.

Alternatively, you can also invest in global market ETFs via a robo advisor in Singapore. Again, you will be buying into portfolios of ETFs instead of an individual ETF

In conclusion, buying ETFs in Singapore is an easy way to gain diversification in both Singapore and Overseas market.