In my existing income-generating portfolio, I have investments in Singapore banks, Real Estate Investment Trusts (REITs), and Singapore Savings Bonds. These have been reliable sources of steady income.

I’m now looking to expand my portfolio to include dividend-paying stocks from the U.S. market. A potential approach is to invest in dividend-focused ETFs. The SPDR® S&P® U.S. Dividend Aristocrats UCITS ETF (UDVD) seems like a suitable addition to diversify my portfolio.

In this review, I’ll delve into the fundamentals of UDVD.

Understanding the Index

UDVD tracks the S&P High Yield Dividend Aristocrats Index. Here’s what you should know about this index.

- What’s Included:

- The S&P High Yield Dividend Aristocrats Index includes companies from the S&P Composite 1500 Index, which is a broad representation of the U.S. stock market.

- How Stocks Are Chosen:

- Stocks are chosen based on three main criteria:

- Market Capitalization: Companies must have a financial size (market capitalization) of at least $2 billion.

- Liquidity: They must be traded enough so that their average daily trading value is at least $5 million over the last three months.

- Dividend Growth: Companies must have a track record of increasing their dividends every year for at least 20 consecutive years.

- Stocks are chosen based on three main criteria:

- Picking Stocks for the Index:

- All eligible stocks that meet the criteria are included in the index during the annual reconstitution.

- Keeping the Index Balanced:

- The index is kept balanced by setting limits on how much each stock can influence the index.

- No single stock can make up more than 4% of the index.

- A stock’s weight in this index cannot be more than 30 times its weight in the broader S&P Composite 1500.

- The total value of stocks that can be bought or sold in one day has to be at least $2 billion. Also, each company has a limit on how much it can influence the index when it is updated.

- The index is kept balanced by setting limits on how much each stock can influence the index.

- Weighting Stocks:

- Stocks in the index are weighted based on their dividend yield, but with certain constraints to maintain balance.

- An optimization program is used to make sure no stock has too much influence in the index. Their goal is to keep the influence of each stock as close as possible to its original level.

[Source: https://www.spglobal.com/spdji/en/methodology/article/sp-dividend-aristocrats-indices-methodology/]

Fundamentals of UDVD ETF

UDVD is a fund that invests entirely in the US stock market and holds a total of 121 different equities.

Asset Allocation

Top 10 Holdings

| Holdings | % of Fund |

|---|---|

| 3M Company | 2.94% |

| International Business Machines Corporation | 2.94% |

| AbbVie Inc. | 2.58% |

| Realty Income Corporation | 2.16% |

| Southern Company | 2.11% |

| Chevron Corporation | 2.04% |

| Exxon Mobil Corporation | 1.98% |

| Consolidated Edison Inc. | 1.89% |

| Kimberly-Clark Corporation | 1.69% |

| T. Rowe Price Group | 1.59% |

| Total | 21.92% |

as of 31 Oct 2023

From the table above, we can see that UDVD’s top holdings span a variety of sectors, including technology, healthcare, energy, utilities, and consumer goods, indicating a diversified approach to investment.

Also, the top ten holdings collectively make up 21.92% of the fund, suggesting a moderate concentration. This indicates a balance between relying on key performers and maintaining diversification.

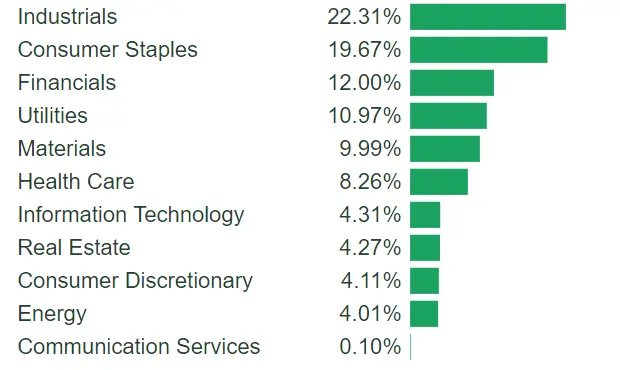

Sector allocation

as of 31 Oct 2023

From the graph above, we can see that the UDVD fund strategically diversifies across the U.S. stock market, focusing on stability and growth.

Industrials and Consumer Staples dominate, emphasizing essential services and goods. Financials and Utilities, known for steady dividends, have notable weights, while Materials and Health Care add diversity.

The fund moderately invests in Information Technology and Real Estate, balancing income and growth. Consumer Discretionary and Energy, equally weighted, reflect a mix of cyclical investments. Communication Services have minimal presence.

Overall, UDVD balances stable, dividend-yielding sectors with growth-oriented ones, aiming to provide a mix of income and capital appreciation for investors.

Performance

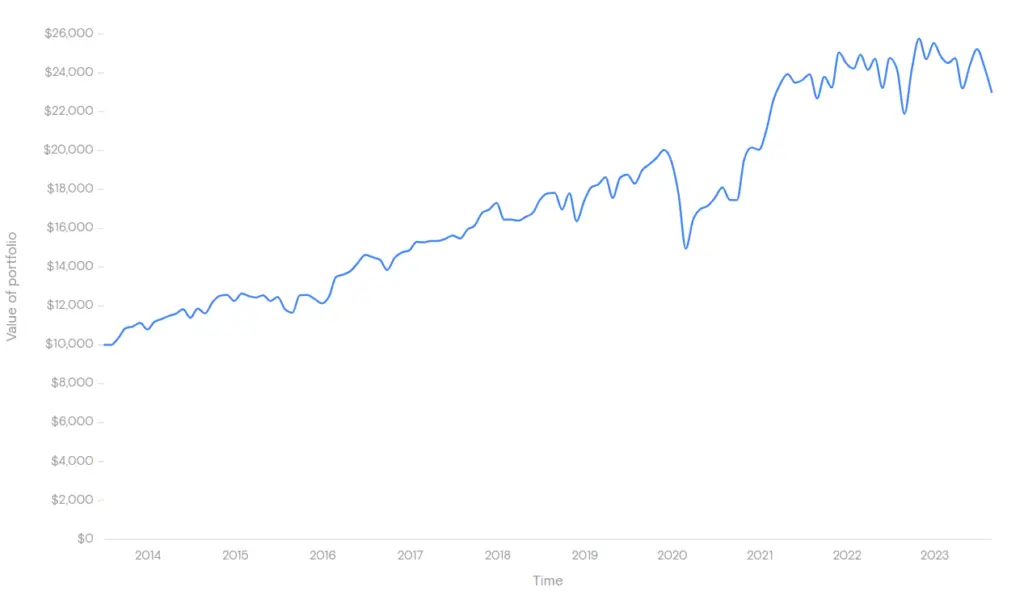

Portfolio Growth

If you had invested $10,000 in UDVD since 2013, your portfolio would have grown to $22,967 at the end of Sep 2023.

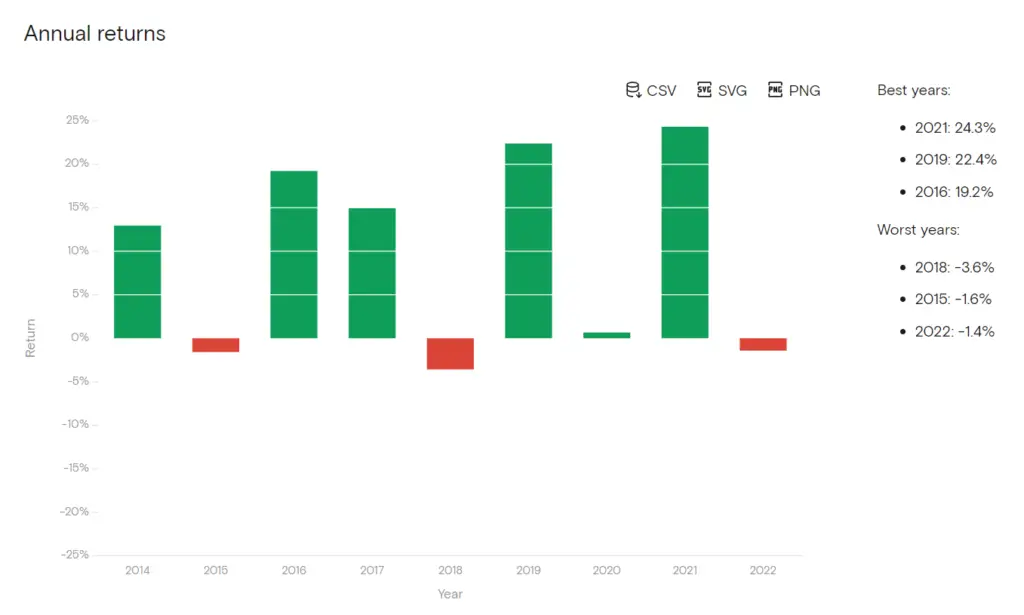

The chart displays the annual returns of the UDVD fund. From the data presented, it’s evident that the fund demonstrated resilience, with its worst year only registering a modest drawdown of -3.6%. Conversely, during its best years, the fund achieved impressive returns, peaking at 24.3%.

Dividend Yield

The UDVD ETF has a dividend yield of 2.49%(TTM) as of 01 Nov 2023. Dividends are payout every quarter.

Dividend Growth

| Year | Dividend Payout | Annual Payout Growth (YoY) |

|---|---|---|

| 2022 | 1.4799 | -3.26% |

| 2021 | 1.5298 | 11.49% |

| 2020 | 1.3721 | -6.35% |

| 2019 | 1.4652 | 71.95% |

| 2018 | 0.8521 | -9.22% |

| 2017 | 0.9386 | -11.69% |

| 2016 | 1.0629 | 76.77% |

| 2015 | 0.6013 | -33.11% |

| 2014 | 0.8989 | 26.66% |

| 2013 | 0.7097 | 19.62% |

| 2012 | 0.5933 | N/A |

The dividend payout amounts and annual payout growth from 2012 to 2022 demonstrate notable variability and volatility. Key points include:

- Dynamic Dividend Distribution: The dividend amounts have fluctuated significantly, suggesting a responsive dividend policy influenced by earnings changes, strategic decisions, and market conditions. The highest payout was in 2021 (1.5298), and the lowest in 2012 (0.5933).

- Inconsistent Annual Growth: The growth rates have been highly volatile, with no clear upward or downward trend. Notable peaks occurred in 2016 (76.77%) and 2019 (71.95%), indicating potential periods of strong performance. Sharp declines, particularly in 2015 (-33.11%), suggest financial challenges or policy changes.

- Overall Upward Movement: Despite fluctuations, there is an overall upward movement in dividend payouts from 2012 (0.5933) to 2021 (1.5298). This suggests a general trend of increasing dividend distributions over the decade.

Expense Ratio

The total expense ratio stands at 0.35%, which is deemed to be a little high for an exchange-traded fund (ETF).

If you invest $100,000 with a 0.35% expense ratio, your annual fee would be $350.

Now, let’s say your investment grows to $200,000. With the same 0.35% expense ratio, your annual fee would then be around $700.

So, as your investment grows over the years, the amount you pay in fees also increases because it’s a percentage of your total investment. This is an important factor to consider, as while the percentage stays the same, the actual dollar amount you’re paying will go up as your portfolio increases in value.

Who Should Consider Investing in UDVD?

Risk Tolerance: Investors with a moderate risk tolerance may find UDVD appealing. The fund’s resilience in market fluctuations and its focus on dividend aristocrats suggest a stable investment. However, its history of volatile dividend growth rates indicates some level of risk.

Investment Horizon: UDVD is well-suited for long-term investors. The fund’s potential for capital appreciation, as seen in the growth of a $10,000 investment to $22,967 since 2013, suggests it’s a viable option for those with a long-term investment outlook.

Income Requirements: Those seeking regular income streams, including retirees or passive income seekers, might consider UDVD due to its quarterly dividend payouts and a reasonable dividend yield of 2.49% (TTM as of 01 Nov 2023).

Diversification Needs: Investors looking to diversify their portfolio, especially those currently focused on Singapore markets, may find UDVD’s exposure to various U.S. sectors beneficial. The fund’s diversified approach across essential services, goods, and growth sectors aligns with diversification objectives.

Expense Sensitivity: With a total expense ratio of 0.35%, UDVD might initially appear less appealing to cost-conscious investors. It’s crucial to recognize that as your investment value increases, the absolute dollar amount paid in fees will also rise in tandem.

However, for non-U.S. residents seeking to invest in UCITS funds, this expense ratio may be considered acceptable given the specific benefits and regulatory protections UCITS funds offer.

Dividend Growth Focus: Those interested in dividend growth may find UDVD intriguing despite its inconsistency in annual growth rates. The overall upward trend in dividend payouts from 2012 to 2021 indicates a potential for growth.

Market Understanding: Investors with a basic understanding of the U.S. stock market might consider UDVD a suitable addition. The fund’s broad representation of the U.S. market through the S&P High Yield Dividend Aristocrats Index makes it a straightforward option for gaining exposure to U.S. equities.

Conclusion

In my quest to enhance my income-generating portfolio, which currently includes Singapore banks, REITs, and Savings Bonds, I’ve explored the potential of incorporating dividend-paying stocks from the U.S. market. The SPDR® S&P® U.S. Dividend Aristocrats UCITS ETF (UDVD) emerged as a promising candidate to achieve this diversification.

UDVD, tracking the S&P High Yield Dividend Aristocrats Index, offers a comprehensive snapshot of the U.S. stock market, focusing on companies with a robust track record of dividend growth. It encompasses a diverse range of sectors, from technology and healthcare to utilities and consumer goods, reflecting a well-rounded investment approach.

The fund’s performance history reveals its resilience, with impressive returns in its best years and modest downturns in its worst. The dividend yield of 2.49% (TTM as of 01 Nov 2023) and the practice of quarterly payouts make it an attractive option for those seeking regular income streams. However, the volatility in annual dividend growth rates indicates some risk, appealing to investors with moderate risk tolerance.

Long-term investors may find UDVD particularly appealing, given its potential for capital appreciation. Its diverse sector allocation caters to those looking to broaden their investment horizons beyond the Singapore market.

However, the 0.35% total expense ratio might give cost-conscious investors pause, though it may be acceptable for non-U.S. residents interested in UCITS funds.

In conclusion, UDVD represents a viable option for investors seeking diversification, regular income, and potential growth, particularly for those with a long-term investment perspective and moderate risk tolerance. Its exposure to a wide range of U.S. sectors makes it a compelling choice for expanding an income-generating portfolio beyond the Singapore market.

As always, it’s prudent to consider your personal financial situation, risk tolerance, and investment objectives before making any investment decisions.