[The Dec SSB 2022 post can be found here.]

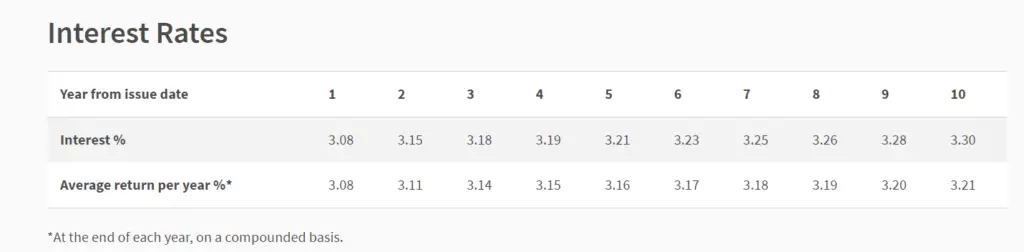

The interest rate for Singapore Savings Bond (SSB) Nov 2022 (SBNOV22 GX22110A) is at at 3.21% p.a. if held to maturity. This is the highest that we have ever seen in the history of SSB.

If you invest $10,000, and hold it to Maturity at the 10th year, you would have earned $3,213.

The 1st year’s interest rate is at 3.08%. If you decide to redeem after the 1st year, you will still earn $308.

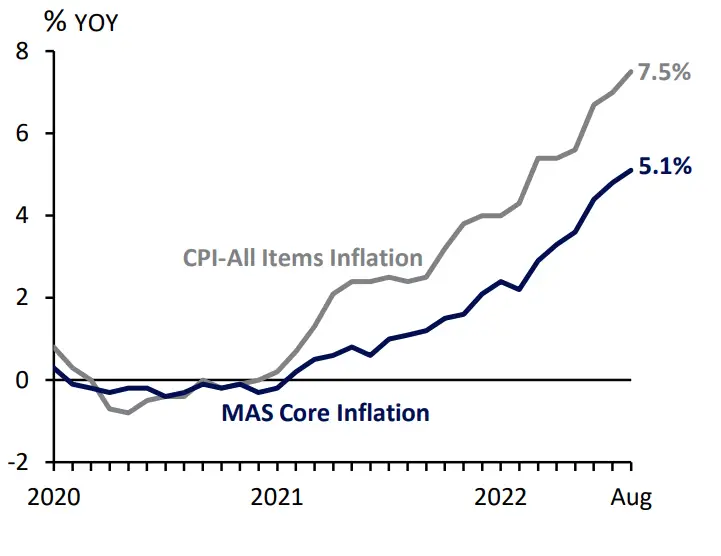

Why is interest rate rising?

Simple answer is because inflation is rising. The core inflation rate in Aug for Singapore rose to 5.1%, from 4.8% in July.

Inflation usually means that there is more demand than supply, thus causing prices to increase.

By increasing interest rates, this makes borrowing more expensive. So lesser people will borrow money to buy things. And hopefully this will bring the demand down, and when there is less demand, then inflation will fall.

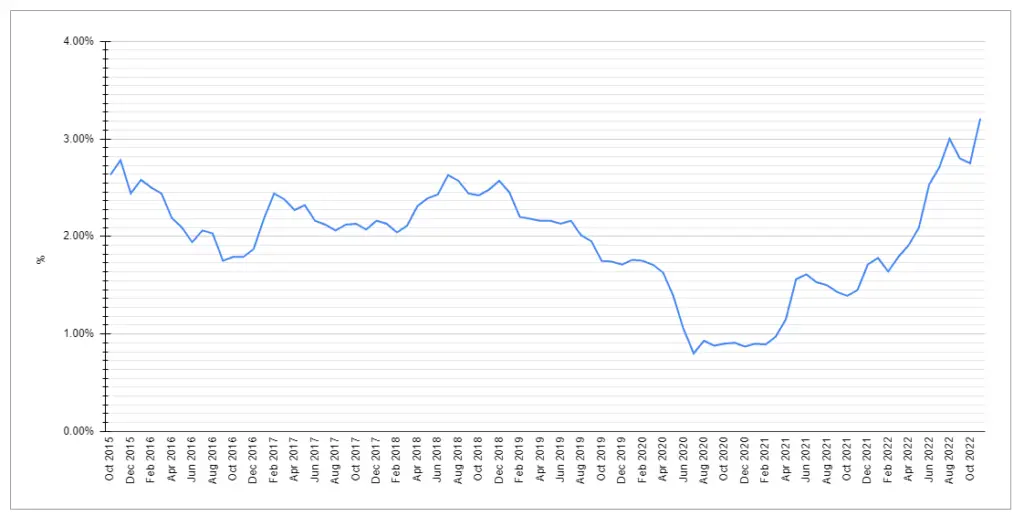

How are SSB interest rates determined?

The SSB on offer in any given month are linked to the daily average SGS yields as published by MAS

https://www.mas.gov.sg/-/media/MAS/News-and-Publications/Press-Releases/Annex-1-FAQ.pdf

in the previous month

Please check out this post for a detailed guide on predicting the future SSB rates.

Should you buy?

If you have money in the bank that are just sitting there doing nothing, it is worth buying some. Otherwise, you will just be losing money to inflation.

With that said, if you are able to hit the different criteria to qualify for the higher interest rates in the OCBC 360 (up to 4.05%), DBS Multiplier (up to 3.5%) or UOB One Account (up to 3.6%), then you should leave your money in the bank.

Another thing to note is, if you haven’t already noticed, the 1st year interest rate is similar to the 10 year interest rate. We are starting to see a flat yield curve which usually implies an uncertain economic outlook. This also means, there might be opportunities to buy into stocks (depending on your risk appetite). So it might make sense to hold some cash to buy the dip.

Let’s do some comparison between SSB and other similar products.

OCBC Time Deposit

At the moment, OCBC is running some promotional interest rate for 12 months tenure at 2.90%. The down side is that your funds will need to be locked for the tenor and min deposit is $20,000.

UOB Fixed Deposit

Similarly, UOB is also running some promotional interest rates for the month of Oct 2022. It seems to be the highest among the banks at the moment, with the 10 month Tenor at 2.8%, 12 month Tenor at 2.9% and 15 month at 3.0%. The down side is that your funds will need to be locked for the tenor and min deposit is $20,000.

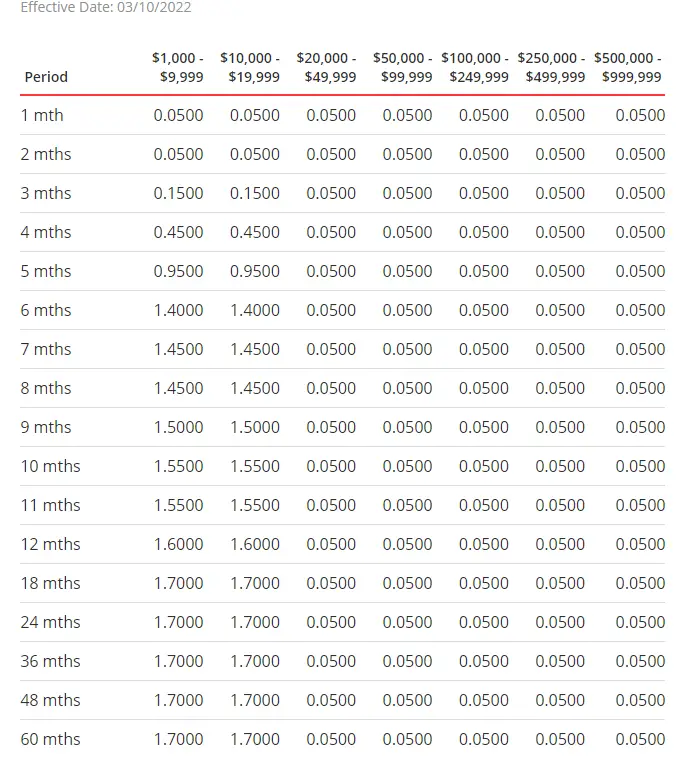

DBS Fixed Deposit

This is a table I pulled up from the DBS Fixed deposit rates. It is between 0.05% to 1.7% depending on the Tenor and the amount. Nothing compared to the SSB rates.

Endowus Cash Smart

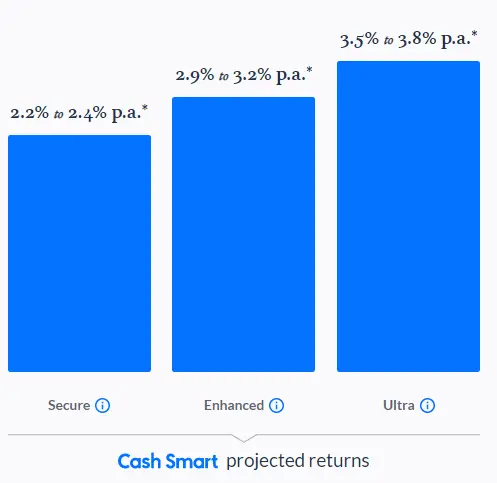

Endowus Cash Smart is offering between 2.2% to 3.8% of projected returns depending on the portfolio. These are not guaranteed returns.

Syfe Cash +

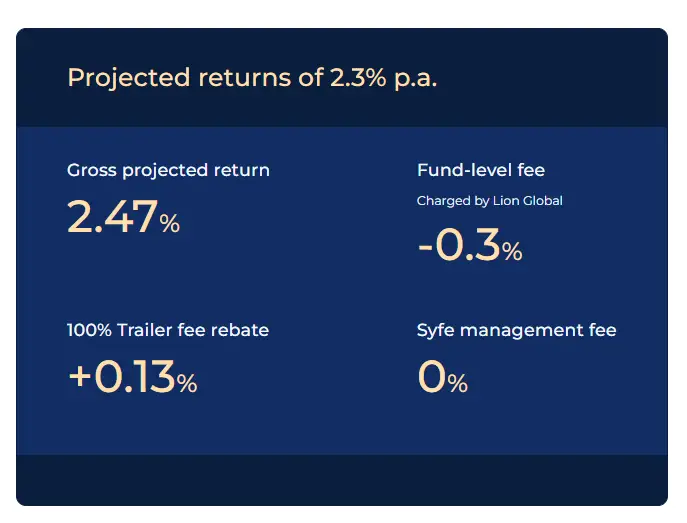

Syfe Cash+ is offering 2.3% of projected returns. Again returns are not guaranteed.

Defi Lending Platforms

DeFi lending platforms such as Aave and Compound are only offering 0.39% and 0.74% respectively on USDC Lending.

Summary

| Product | Yield |

|---|---|

| SSB | 3.21% (10 yrs Guaranteed), 3.08% (1st yr, Guaranteed) |

| OCBC Time Deposit | 2.9% (Guaranteed) depending on the Tenor and min deposit is $20,000 |

| UOB Fixed Deposit | 2.8%-3.0% (Guaranteed) depending on the Tenor and min deposit is $20,000 |

| DBS Fixed Deposit | 0.05% – 1.7%% (Guaranteed) depending on the Tenor |

| Endowus Cash Smart | 2.2% to 3.8% depending on the portfolio (Projected Returns) |

| Syfe Cash+ | 1.9% (Projected Returns) |

| Aave (Defi) | 0.39% (rates fluctuates depending on supply and lending volume) |

| Compound (Defi) | 0.71% (rates fluctuates depending on supply and lending volume) |

Based on the comparison above, one can consider SSB as it has a guaranteed 3.21% p.a. The Fixed Deposit from OCBC and UOB are also attractive. Only downside is that the funds need to be locked for the tenure and you will need to deposit at least $20,000 to qualify for the rates.

Is SSB safe?

SSB is fully backed by the Singapore Government. This means that you can always get your full investment amount with no capital loss.

Singapore bonds has a credit rating of AAA. This shows that Singapore bonds has strong creditworthiness, with a very low probability rate of default.

So I think a better question is, do you trust the Singapore Government?

How to buy SSB?

You can apply through internet banking or through DBS/POSB, OCBC and UOB ATMs. Check out this Step By Step guide on How to buy SSB.

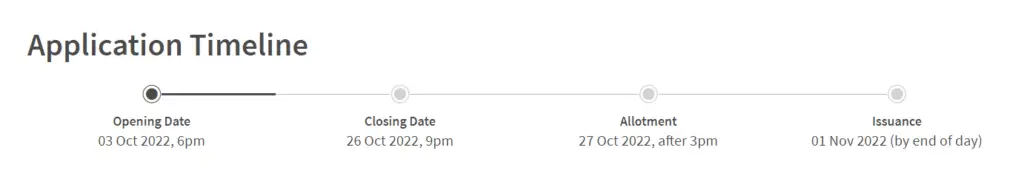

You have between now till 26 Oct 2022, 9pm to apply.

There is a min amount of $500, and in multiples of $500. And the total amount of SSB you hold cannot exceed $200,000 at any given one time .

You can find out more about this month’s SSB.

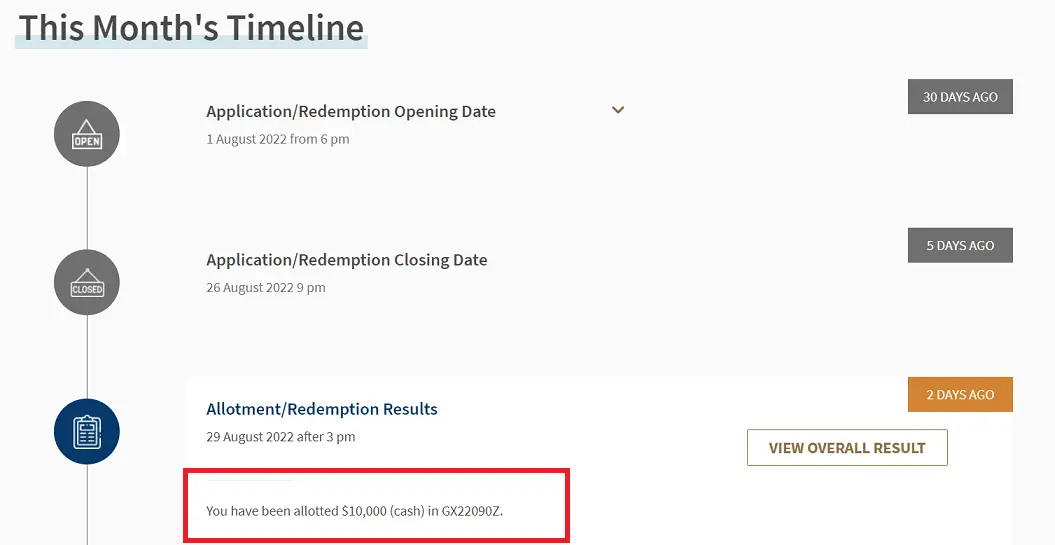

How to check your SSB Allocation?

New SSB will be allocated on the 3rd last business day of the month (called the Allotment Day). You can check the results of your allocation after 3pm on Allotment Day.

Simply login to https://eservices.mas.gov.sg/ssb/ with your Singpass App. And you can see the results.

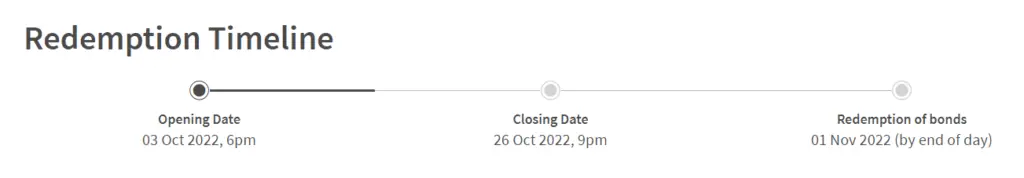

Can SSB be redeemed early?

Yes, SSB can be redeemed at any given month with no penalty. You will be paid the principal plus any accrued interest. You should redeem the bonds before the Closing Date for it to be paid out on the 2nd business day of next month.

SSB is flexible in a way that you can get your principal by next month, but it is not flexible enough if you need the money now. So you should always have a stash of emergency money in the bank before putting any into SSB.

Cash investment for SSB can be redeemed via DBS/POSB, OCBC and UOB’s internet banking or ATMs.