When I first started working 20 years ago, there was no internet. There were no blogs that teaches you how to invest in Singapore. Just opening a savings account, I had to head down to the bank in person. While I was there, some sales guy talked me into buying an investment linked insurance.

Fast forward to 12 years later, this investment that I bought barely broke even. What happened? I found out that premium for the first few years rarely goes into buying the unit trust funds. Most of it went into the insurance expenses. I think this article describes it really well.

Back then, we don’t have online resources like we do now, to educate ourselves on how insurance policies actually work, and what type of insurance is suitable for what needs. You get these from your financial advisors.

Things are different back then compared to now. Now, we have Robo-advisors which we can open accounts online without heading to a bank. We can also start a Regular Savings Plan by buying into stocks every month. Or you can just buy into a Singapore Savings Bond via any of the local bank’s online banking system.

The focus here is the Invest Saver by DBS/POSB. Why DBS/POSB? This is the bank account that most local has. It saves you the trouble to setup another brokerage account.

And most importantly, you can automate this process of investing every month. Sometimes, we may end up over researching on what stocks to buy, that we end up not investing because of analysis paralysis. Or we keep waiting to time the market. With automation, we do not have emotions tied when investing.

20 years ago, I’m not sure if there is such plan where I can invest $100 every month into the Singapore Straits Times(STI) Index. But I’m certain that, if I am 20 years old now, and just started working, with extra income to invest, I would want to know how to invest in Singapore with as little as $100!

Investing into STI index ETF means that you are investing into companies like DBS, UOB, OCBC, CAPITALAND and much more. You can find out all the companies that make up the STI index here. There is no way you can buy into these companies for $100 if you were to buy them individually.

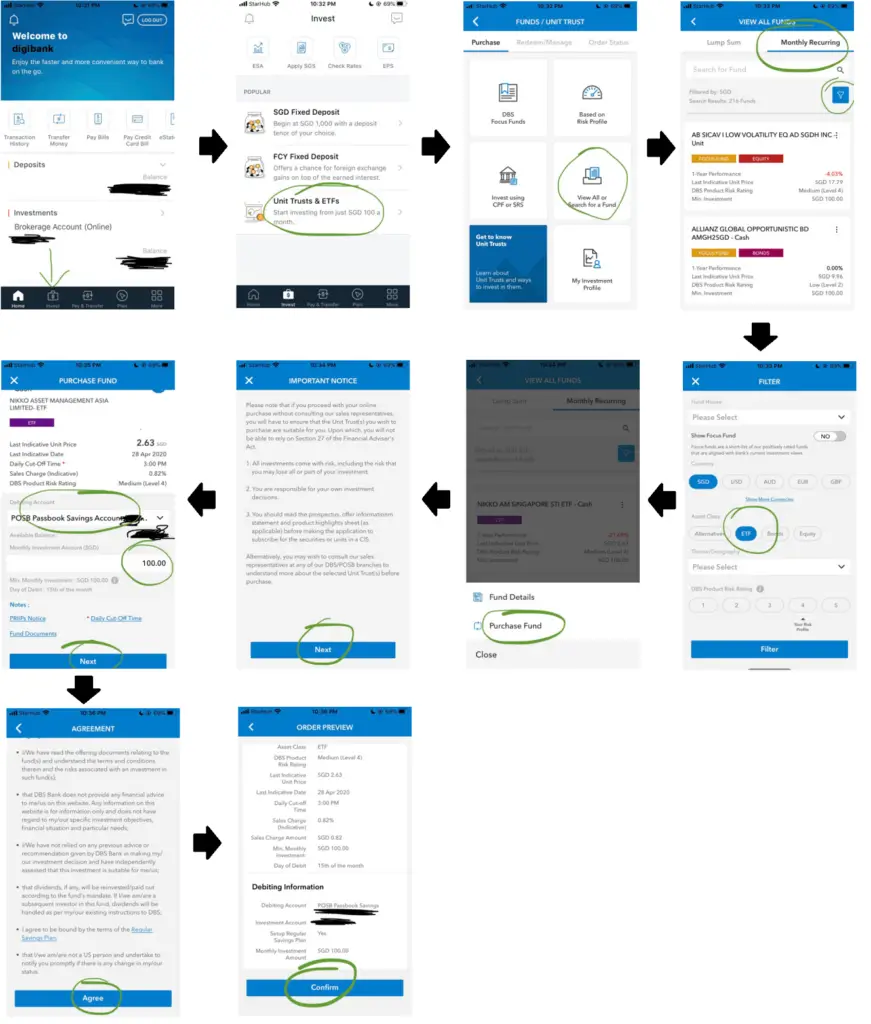

In the next 15 mins, using the DBS banking app, you can start investing in STI ETF at just 0.82% transaction cost. This means that for every $100 you invest, $99.18 goes straight to buying the STI ETF. Compared to my experience, this is so much better.

So how to invest in Singapore with as little as $100?

Below is a simple step by step guide:

Congratuations on taking your first step to growing your wealth.

A lot of times, we tend to overthink the process and make it complicated to even take action. I hope that 20 years down the road, where you look back and you will be glad that you started this journey.

Disclaimer: This guide assumes that you know the risks that comes with any sort of investments.