Unfortunately, the truth is, you need money to make this work. Which is why I truly believe that you should be thinking about how to make more money, rather than scrimping to reduce your expenses. I wrote a post previously about Increase income vs reduce expenses which explore this topic in depth.

With this portfolio, I’m targeting between 3%-4% of passive income. You can have a $1,000 portfolio that generates 4% income per year. But this will only be $40 per year. But if you have $100,000 portfolio, then you will be able to generate passive income of $4,000 per year. Having said that, you should always start from somewhere. $1,000 is a great amount to start with too.

Components

This portfolio will make up of 3 components. REITs, bank stocks and Singapore Savings Bond. Why these?

REITs

MoneySense has a very good article on REITs. But the main reason for choosing REITs is that they must pay out at least 90% of taxable income each year to enjoy tax transparency treatment by IRAS. This means we should have stable income from REITs (provided REITs does not go underwater).

This is why, I am using Syfe REITs+. You get diversification into the top REITs in Singapore. Because I plan on investing monthly, Syfe is a great platform for my to automate my investment every month.

If you have a lump sum, you can definitely look into buying a REITs ETF.

Bank Stocks

Our Singapore Banks pays out rather good dividend yield of between 3-4% (depending on the price of the stocks).

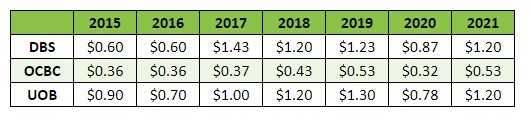

The table above shows the dividend history of the 3 banks for the past 6 years. With the exception of 2020 (where MAS called on local banks to cap their total dividend payout at 60%), we can see that the banks has been increasing they dividend payout.

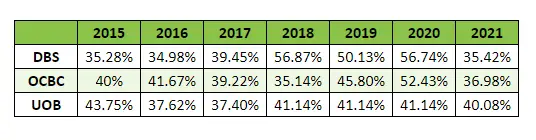

The table above shows the payout ratio. All the banks display rather healthy ratio between 35-56%. This means the banks are paying out $0.35-$0.56 as dividend for every $1 earned, which also means the dividend is sustainable.

I’m currently using the OCBC’s BCIP (Blue Chip Investment Plane) to buy into DBS every month. You can check out my review of OCBC’s BCIP to find out more.

Singapore Savings Bond (SSB)

Recently, the interest rates for SSB has been rising, so I have been accumulating some SSB since May 2022. As long as you believe in the Singapore Government, I pretty much see this as a no risk interest bearing bond. You can check out my recent post on whether to buy SSB.

Allocation

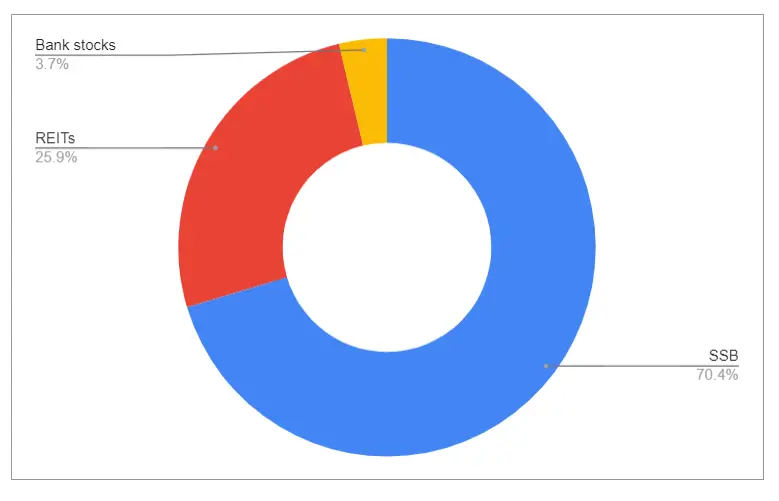

I’m planning to get my portfolio up to following allocation:

- REITs – 40%

- Bank Stock – 40%

- SSB – 20%

At the moment I have been more aggressive in buying the SSB because of the higher interest. Will be adjusting the portfolio more to the 40%-40%-20% allocation in the future.

Conclusion

I’m stacking more of SSB now since the interest rates is rising. And I am dollar cost averaging into DBS and Syfe REITs just in case we see a market crash in the coming months.

There you have it. This is my simple plan of building an income portfolio. Hope you find it useful.

As always, None of the content that I write on this site should be taken as financial advice.