An Overview: ARKK vs ARKQ

| ARKK (Innovation ETF) | ARKQ (Autonomous Technology & Robotics ETF) | |

|---|---|---|

| Objective | Thematic multi-cap exposure to innovation across sectors | Thematic multi-cap exposure to innovation elements including robotics, autonomous vehicles, energy storage, 3D printing, and space exploration. |

| Fund Type | Active ETF | Active ETF |

| Inception Date | 31 Oct 2014 | 30 Sep 2014 |

| Fund AUM | $17.68 B | $1.7 B |

| Expense Ratio | 0.75% | 0.75% |

Source: ark-funds.com

WHAT IS THE DIFFERENCE BETWEEN ARKK AND ARKQ?

The main difference is that ARKK invest in innovation across different sectors, whereas ARKQ invests in companies that focus on disruptive autonomous technology and robotics.

ARKK includes companies that are related to these 4 innovation sectors:

- DNA technologies (‘‘Genomic Revolution”)

- industrial innovation in energy, automation and manufacturing (‘‘Industrial Innovation’’)

- the increased use of shared technology, infrastructure and services (‘‘Next Generation Internet’)

- technologies that make financial services more efficient (‘‘Fintech Innovation’’)

ARKK is a more diversified ETF as in invests in companies across different innovation sectors.

ARKQ invests in disruptive companies that focus on:

- robotics

- autonomous vehicles

- energy storage

- 3D printing

- space exploration

You can see the difference between ARKK vs ARKQ in this Technology Breakdown Table:

| ARKK | ARKQ | |

|---|---|---|

| Autonomous Vehicles | 3.1 % | 40.0 % |

| 3D Printing | 6.0 % | 18.9 % |

| Robotics | 1.4 % | 17.1 % |

| Energy Storage | 3.5 % | 14.3 % |

| Space Exploration | 1.1 % | 6.1 % |

| Development of Infrastructure | 1.1 % | 2.9 % |

| Innovative Materials | – | 0.1 % |

| Alternate Energy Sources | – | 0.1 % |

| E-Commerce | 12.0 % | – |

| Digital Media | 9.7 % | – |

| Cloud Computing | 9.4 % | – |

| Gene Therapy | 8.9 % | – |

| Big Data & Machine Learning | 7.5 % | – |

| Mobile | 7.3 % | – |

| Internet of Things | 5.9 % | – |

| Molecular Diagnostics | 5.7 % | – |

| Bioinformatics | 4.3 % | – |

| Beyond DNA | 3.7 % | – |

| Targeted Therapeutics | 2.8 % | – |

| Instrumentation | 2.3 % | – |

| Next Generation Oncology | 1.5 % | – |

| Social Platforms | 1.4 % | – |

| Blockchain & P2P | 1.2 % | – |

Source: ark-funds.com

Top 10 Holdings

| ARKK | ARKQ |

|---|---|

| TESLA INC (9.68%) | TESLA INC (10.77%) |

| ROKU INC (6.80%) | TRIMBLE INC (4.37%) |

| TELADOC HEALTH INC (5.07%) | MATERIALISE NV-ADR (4.35%) |

| SQUARE INC – A (4.51%) | BAIDU INC – SPON ADR (4.35%) |

| CRISPR THERAPEUTICS AG (3.99%) | JD.COM INC-ADR (4.22%) |

| INVITAE CORP (3.65%) | DEERE & CO (4.19%) |

| SPOTIFY TECHNOLOGY SA (3.09%) | ALPHABET INC-CL C (3.69%) |

| BAIDU INC – SPON ADR (2.84%) | KRATOS DEFENSE & SECURITY (3.46%) |

| ZILLOW GROUP INC – C (2.82%) | NANO DIMENSION LTD – ADR (3.26%) |

| PROTO LABS INC (2.66%) | VIRGIN GALACTIC HOLDINGS INC (3.10%) |

| 45.11% of total asset | 45.76% of total asset |

| View updated full list of ARKK holdings | View updated full list of ARKQ holdings |

Source: ark-funds.com

From the above table, we can see that the top 10 makes up almost half of the total asset for both ETFs. This might seem like a rather extreme % for just the top 10 holdings. But it is important to remember that these ETFs are narrowly focused on disruptive innovation companies, unlike a broader global index fund.

We can also see that there are overlaps in the companies that each ETF buys into.

If we dive further into the full list of holdings for each ETFs, you can see that there are actually 15 overlapping counters between these 2 ETFs. If you are buying ARKK, you are also buying part of ARKQ.

PERFORMANCE OF ARKK VS ARKQ

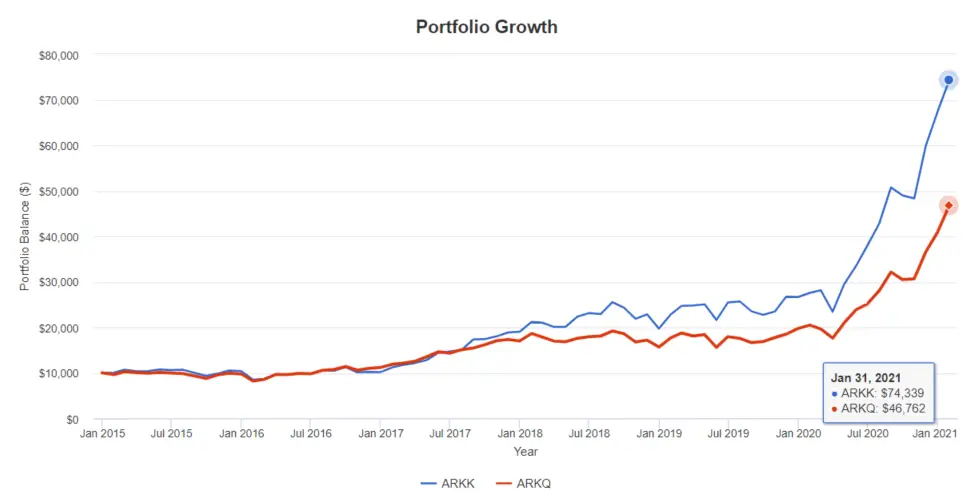

Using the portfolio visualizer, I ran a back test on these 2 ETFs starting from inception date with an initial investment of $10,000. And this is what you will end up with in Jan 2021 if you have invested $10,000 at the end of 2014.

ARKK (ARK Innovation ETF): $74,339

ARKQ (ARK Autonomous Technology & Robotics ETF): $46,762

From the graph above, we can see that ARKK outperforms ARKQ by an additional $27,577 (58%) in returns.

If you compare both of these performances against the S&P 500 index, the S&P 500 index pales in comparison.

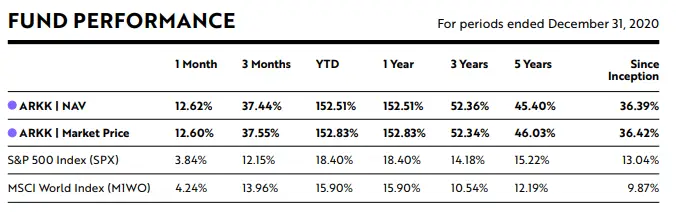

Both ARKK and ARKQ has a annualized returns of 45.40% and 33.30% respectively compared to the 15.22% that S&P 500 has in the last 5 years

Conclusion

Based of historical performance, ARKK is the one to pick with a 5 year annualized return of 45.4% over ARKQ’s 33.30%. And on top of that ARKK is more diversified as it invest across the different innovation sectors.

Personally, I am also not too fond of ARKQ because it has almost 20% of the fund in 3D printing, an area where I think can become more commoditized.

That said, there is however one technology that piqued my interest. Space Exploration! But I would not buy ARKQ because of that. I would rather wait for ARKX launch(the Space Exploration ETF that ARK is planning to add).

Last thing to note is that both these ETFs are narrowly focused in the innovation industry, so they are considered really high risk. They can be used to complement your portfolio, but they shouldn’t form the core.

And always remember that Past Performance is No Guarantee of Future Results.